Mastering Online Forex Trading Strategies, Tips, and Tools 1709332594

Online forex trading has revolutionized the way individuals and institutions participate in the foreign exchange market. The ability to trade currencies anytime and anywhere has opened up new opportunities for profit, but it also brings its own set of challenges. In this extensive guide, we’ll delve into the essentials of trading online forex, providing valuable insights for both beginners and experienced traders. For those interested in trading in compliance with their beliefs, consider exploring trading online forex Islamic Trading Platform. Let’s dive into the intricate world of forex trading.

Understanding the Forex Market

The forex market, or foreign exchange market, is the largest financial market in the world, with a daily trading volume exceeding $6 trillion. This decentralized market allows participants to buy, sell, exchange, and speculate on currencies. Major forex trading centers include New York, London, Tokyo, and Sydney, with traders actively engaging at all hours due to the market’s 24/5 operation.

Types of Forex Trading

Forex trading can be categorized into several types, including:

- Spot Trading: Involves buying and selling currencies for immediate delivery.

- Forward Trading: Contracts to buy or sell currencies at a future date and at a predetermined rate.

- Futures Trading: Similar to forward trading but involves standardized contracts traded on exchanges.

- Options Trading: Gives traders the right, but not the obligation, to buy or sell currencies at a specific price before a certain date.

Getting Started with Online Forex Trading

If you’re new to forex trading, follow these steps to get started:

- Educate Yourself: Understanding the basics of currency pairs, pips, and market analysis is crucial. Many educational resources, such as online courses and webinars, are available.

- Choose a Reliable Broker: Select a forex broker that suits your needs, considering factors such as spreads, commissions, and trading platforms. Always ensure the broker is regulated.

- Open a Trading Account: You can begin with a demo account to practice trading without real money before transitioning to a live account.

- Develop a Trading Plan: A well-thought-out trading plan is essential. Outline your trading goals, risk tolerance, and strategies.

- Start Trading: Once comfortable, you can start placing trades. Begin with a small investment and gradually increase it as you gain experience.

Key Strategies for Successful Trading

To achieve success in forex trading, consider implementing the following strategies:

1. Technical Analysis

Technical analysis involves analyzing price charts and using various indicators to predict future price movements. Traders often use tools such as moving averages, Relative Strength Index (RSI), and Fibonacci retracement levels.

2. Fundamental Analysis

This approach focuses on the economic indicators, news events, and geopolitical factors that influence currency values. Understanding interest rates, inflation, and unemployment rates can provide crucial insights into market movements.

3. Risk Management

One of the most critical aspects of trading is managing risks. Implement strategies such as setting stop-loss orders, maintaining a proper risk-to-reward ratio, and diversifying your trading portfolio.

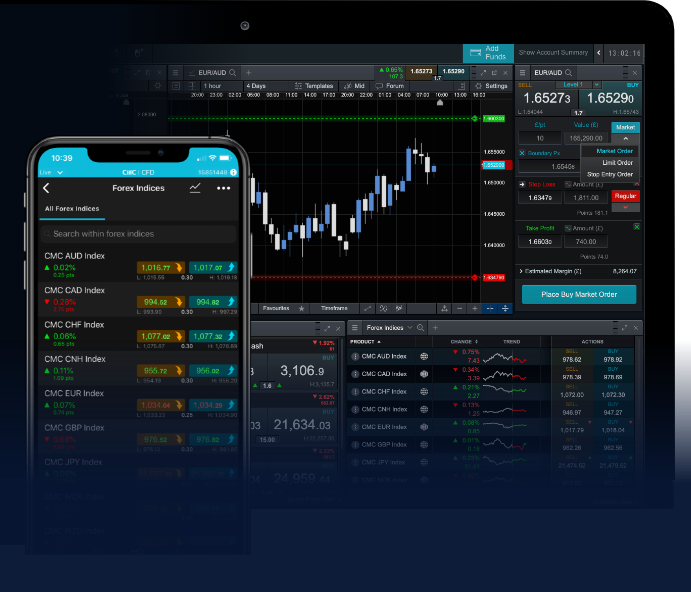

Technology and Tools for Online Forex Trading

Advanced trading platforms and tools can enhance your trading experience significantly. Look for platforms that provide:

- Real-time Data: Access to live market quotes and news updates is crucial for making informed decisions.

- Charting Tools: Advanced charting features help visualize price patterns and trends effectively.

- Automated Trading: Utilize algorithms and expert advisors (EAs) to automate your trading strategies.

- Mobile Trading: Many brokers offer mobile applications, allowing you to trade on the go.

Common Mistakes in Forex Trading

While navigating the forex market, traders often encounter several pitfalls. Avoid the following common mistakes:

- Lack of Research: Failing to research before entering the market can lead to poor trading decisions.

- Overleveraging: Using too much leverage increases the risk of significant losses. Always trade within your means.

- Emotional Trading: Making decisions based on emotions rather than strategies can result in losses. Stick to your trading plan.

- Pursuing Perfection: Understand that losses are a part of trading. Focus on long-term profitability rather than individual trades.

The Future of Online Forex Trading

The forex market continues to evolve with the advent of technology and algorithms. The rise of artificial intelligence and machine learning is transforming how traders analyze data and execute trades. Additionally, the growing popularity of cryptocurrencies presents new trading opportunities.

Conclusion

Online forex trading offers the potential for substantial profits, but it requires dedication, knowledge, and strategic planning. By understanding the market, employing effective strategies, and utilizing technology, traders can increase their chances of success. Remember to stay informed about market trends, continuously improve your skills, and adopt a disciplined approach to trading. With the right mindset and resources, you can navigate the complexities of the forex market and achieve your financial goals.