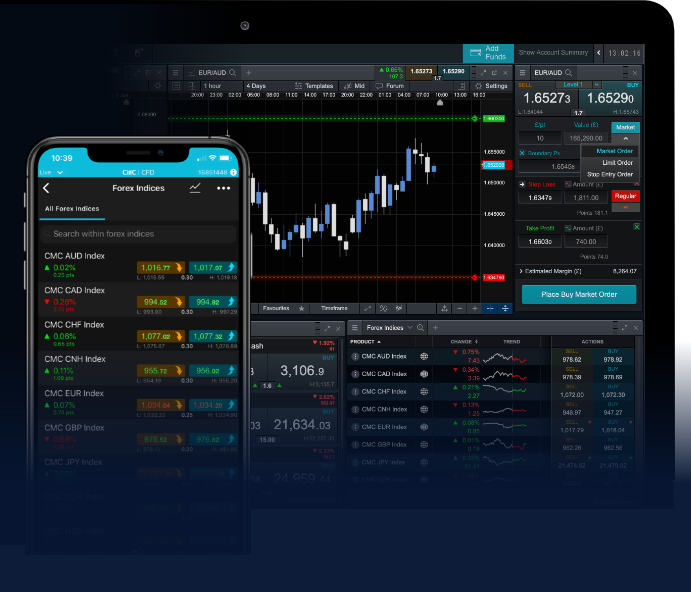

Optimizing Forex Trading with Reliable Servers

In the dynamic world of forex trading, the choice of infrastructure can significantly influence your trading performance. Among the crucial components is the trading server that you use for executing trades. A high-quality forex trading server can enhance your trading experience remarkably. Whether you are a novice or an experienced trader, understanding the role of forex trading servers is imperative. In this article, we will delve into what forex trading servers are, their types, and how they can make a difference in your trading activities. Don’t forget to explore platforms like forex trading servers Latin America Trading that provide excellent trading infrastructures.

What are Forex Trading Servers?

Forex trading servers are specialized servers used to facilitate the trading of forex currencies. These servers act as the backbone of a trading platform, allowing for the real-time execution of trades, data analysis, and communication between traders and the trading platform. They are equipped to handle large volumes of transactions and ensure that trades are executed at lightning speed. Considering the technicalities of forex trading, having a reliable server is crucial for succeeding in the market.

Types of Forex Trading Servers

There are several types of forex trading servers that cater to different trading needs:

- Dedicated Servers: These are reserved exclusively for a single trader or trading firm, providing optimal performance and speed. Dedicated servers are ideal for high-frequency traders who require minimal latency and maximum reliability.

- Virtual Private Servers (VPS): VPS hosting allows traders to operate their trading systems on virtual machines that run on robust physical hardware. This solution is cost-effective and offers better performance than traditional shared hosting.

- Cloud-Based Servers: Utilizing cloud technology, these servers provide scalability and flexibility. They can dynamically allocate resources based on the trader’s requirements, which ensures continuous availability and reliability.

- Colocated Servers: These servers are located in the same data center as the exchange, ensuring the fastest possible connection and execution speeds. This is particularly advantageous for traders who rely on high-frequency trading strategies.

Importance of Choosing the Right Trading Server

The selection of a trading server is not just a matter of preference; it significantly impacts the trading experience. Here are some crucial factors to consider:

- Speed and Latency: In forex trading, every millisecond counts. A server with low latency ensures that your orders are executed swiftly, reducing the chances of slippage and maximizing profitability.

- Uptime and Reliability: A reliable trading server should have minimal downtime to ensure continuous trading opportunities. Look for providers that offer at least 99.9% uptime.

- Location: The geographical location of the server can influence speed. Servers located near major financial institutions and exchanges can offer faster execution times.

- Security: Your trading data must be protected from cyber threats. Ensure that the server provider implements robust security measures, including encryption and firewalls.

- Support and Maintenance: Choose a server provider that offers responsive customer support. In times of technical issues, having access to competent support can make a significant difference.

Enhancing Trading Performance with Forex Servers

Investing in a high-quality forex trading server can yield substantial benefits for your trading performance. Here’s how:

- Faster Order Execution: With a reliable trading server, your orders will be executed almost instantaneously, allowing you to capitalize on market movements effectively.

- 24/7 Availability: A well-maintained server can operate around the clock, enabling you to trade at any time without interruptions.

- Increased Algorithmic Trading Efficiency: Algorithmic traders depend on speed and accuracy. A powerful server can run complex algorithms and programs efficiently, resulting in better trading outcomes.

- Access to Real-Time Data: A robust server provides access to real-time market data, allowing for informed decision-making and quick reactions to market changes.

Popular Forex Trading Server Providers

Choosing a trading server provider requires careful consideration of various factors, including reputation, service offerings, and customer reviews. Here are some well-known forex trading server providers:

- Amazon Web Services (AWS): AWS offers scalable cloud services that are ideal for forex trading applications due to their reliability and flexibility.

- Vultr: Known for its affordable VPS solutions, Vultr provides great performance and an easy setup process for traders.

- ForexVPS.net: Specializing in forex trading, ForexVPS offers tailored VPS solutions for traders looking for low latency and high performance.

- InterServer: They provide dedicated and VPS hosting options that can cater to the specific needs of forex traders, ensuring fast execution and reliability.

Conclusion

In conclusion, your choice of forex trading server can significantly impact your trading results. A reliable server can enhance order execution speed, reduce latency, and provide access to real-time data, all of which are crucial for successful trading. By understanding the different types of servers and their benefits, as well as considering factors like speed, reliability, and support, you can make an informed choice that aligns with your trading strategy. As you embark on your trading journey, remember that investing in the right tools, including a robust trading server, is key to achieving your trading goals.